ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

113.17

-0.83 (-0.73%)

NYSE · Last Trade: Feb 17th, 9:24 PM EST

Detailed Quote

| Previous Close | 114.00 |

|---|---|

| Open | 114.00 |

| Day's Range | 112.64 - 114.58 |

| 52 Week Range | 89.76 - 115.31 |

| Volume | 709,480 |

| Market Cap | 126.41M |

| Dividend & Yield | 2.644 (2.34%) |

| 1 Month Average Volume | 803,947 |

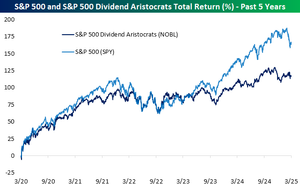

Chart

News & Press Releases

Explore how these two dividend ETFs differ in cost, sector focus, and risk to help refine your income investing strategy.

Via The Motley Fool · February 11, 2026

Explore how these two income-focused ETFs differ in cost, sector exposure, and portfolio breadth for diversified dividend strategies.

Via The Motley Fool · February 7, 2026

Together, investing in these funds can give you a position in many of the top dividend stocks and growth stocks in the world.

Via The Motley Fool · January 23, 2026

Begin your search with your specific goals in mind, and then ask yourself which fund is best-suited to meet them.

Via The Motley Fool · January 22, 2026

Dividend-growth and high-yield strategies can produce very different portfolios and results, but one strategy looks better right now.

Via The Motley Fool · January 19, 2026

Albemarle Corp shares rose 2.6% in premarket trading on Tuesday, following a Deutsche Bank upgrade to ‘buy’ from ‘hold’.

Via Stocktwits · January 13, 2026

It's time to start thinking strategically -- and even philosophically -- about how seemingly similar funds are actually quite different.

Via The Motley Fool · January 11, 2026

Both ETFs target reliable income, but VIG emphasizes low-cost dividend growth while NOBL prioritizes balance and risk control through disciplined construction.

Via The Motley Fool · January 5, 2026

Expense-conscious investors weighing sector breadth and portfolio focus will find key differences between these two dividend ETFs.

Via The Motley Fool · January 4, 2026

Expense ratios, sector tilts, and dividend strategies set these two popular ETFs apart for investors seeking the right portfolio fit.

Via The Motley Fool · January 4, 2026

Both funds focus on dividend consistency, but their index construction leads to distinct outcomes as market leadership shifts.

Via The Motley Fool · December 30, 2025

Both ETFs target dividend paying stocks, but their rules determine whether investors receive higher income or stricter dividend consistency

Via The Motley Fool · December 22, 2025

If you're looking for an ETF that can deliver steadily increasing income for the next several decades, SCHD pairs quality, durability, and dividend growth in one single portfolio.

Via The Motley Fool · December 14, 2025

These funds are relatively stable, diverse, and yield more than the average stock on the S&P 500.

Via The Motley Fool · December 12, 2025

Vanguard VYM Offers Broader Diversification Than NOBL

Via The Motley Fool · November 9, 2025

Schwab U.S. Dividend Equity ETF (SCHD) Offers Higher Yield and Lower Fees Than ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

Via The Motley Fool · November 4, 2025

Vanguard Dividend Appreciation Fund (VIG) Offers Broader Diversification, But ProShares S&P 500 Dividend Aristocrats ETF (NOBL) Has a Higher Dividend Yield

Via The Motley Fool · November 4, 2025

ProShares launches URSP, a 2x leveraged S&P 500 Equal Weight ETF, offering investors big returns without Big Tech concentration risk.

Via Benzinga · August 28, 2025

Via The Motley Fool · July 4, 2025

A small twist in which stocks are allowed into this index makes a world of difference.

Via The Motley Fool · June 28, 2025

Contrary to what your action-seeking gut is telling you, simpler is better, and trading less produces more net gains.

Via The Motley Fool · June 16, 2025

This particular fund bucks one of investing's most common frustrations by not forcing you to compromise.

Via The Motley Fool · June 2, 2025

They're all compelling on their own, but together, they're a formidable income-driving trio.

Via The Motley Fool · April 27, 2025

One of the most well-known dividend strategies is owning Dividend Aristocrats, of which the NOBL ETF tracks.

Via Talk Markets · March 20, 2025