Visa (V)

331.58

+2.45 (0.74%)

NYSE · Last Trade: Feb 8th, 5:47 AM EST

Detailed Quote

| Previous Close | 329.13 |

|---|---|

| Open | 331.78 |

| Bid | 331.24 |

| Ask | 331.80 |

| Day's Range | 327.10 - 335.13 |

| 52 Week Range | 299.00 - 375.51 |

| Volume | 7,798,819 |

| Market Cap | 562.40B |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 2.680 (0.81%) |

| 1 Month Average Volume | 8,888,645 |

Chart

About Visa (V)

Visa is a global payments technology company that facilitates digital payments through its extensive network, enabling secure and efficient transactions for consumers, merchants, and financial institutions. By providing a variety of services, including credit and debit card processing, electronic payment solutions, and fraud prevention, Visa connects buyers and sellers across the world. The company plays a crucial role in the modernization of the payments landscape, continually innovating to enhance user experience, expand access to financial services, and support economic growth through its partnerships with various stakeholders in the financial ecosystem. Read More

News & Press Releases

American Express stock has tripled in five years. A recent premium card relaunch suggests the good times aren't over yet.

Via The Motley Fool · February 7, 2026

As the ceremonial fires of the XXV Olympic Winter Games flicker in the dual host cities of Milan and Cortina d'Ampezzo, the world’s attention has shifted from the spectacle of the opening ceremony to the high-stakes reality of the podium. On the world’s leading prediction platform, Polymarket, a clear consensus has emerged: Norway is the [...]

Via PredictStreet · February 7, 2026

The leader in electronic payments is struggling to get back to its pandemic highs.

Via The Motley Fool · February 7, 2026

Could Buying American Express (AXP) Today Set You Up for Life?fool.com

Via The Motley Fool · February 4, 2026

Charge1 strengthens its payment gateway with network-level card updates for more reliable recurring billing

Via PRUnderground · February 7, 2026

Answrr, the AI receptionist platform developed by AIQ Labs Limited, today announced the launch of its affiliate program — quickly earning recognition as the best AI SaaS affiliate program of 2026. The program offers affiliates 30% lifetime recurring commissions on every customer referral, positioning it as the highest-paying opportunity in the enterprise AI voice automation sector.

Via AB Newswire · February 6, 2026

In a landmark shift for the global financial sector, Malaysia has officially entered the era of autonomous finance with the full-scale operation of Ryt Bank, the nation’s first—and one of the world’s most advanced—fully AI-powered digital banks. Launched in late 2025 and hitting its stride in early 2026, Ryt Bank represents a radical departure from [...]

Via TokenRing AI · February 6, 2026

WASHINGTON, D.C. — In a week that has sent tremors through the global financial architecture, Treasury Secretary Scott Bessent appeared before the Senate Banking Committee on February 5, 2026, delivering testimony that many economists believe signals a fundamental shift in the relationship between the White House and the Federal Reserve.

Via MarketMinute · February 6, 2026

Two standout companies from the same sector (no, not technology) have a clear path to follow in Walmart's footsteps.

Via The Motley Fool · February 6, 2026

The powerhouse financial stock hasn't looked all that mighty lately.

Via The Motley Fool · February 5, 2026

Visa (NYSE: V) today announced the launch of Visa & Main, a new platform designed to give small business owners across the United States better access to the resources they need to succeed. Built in direct response to the most pressing challenges entrepreneurs face—access to capital, reaching customers and adopting modern business tools—the platform brings together capabilities across Visa’s network to help small businesses succeed.

By Visa Inc. · Via Business Wire · February 5, 2026

"Too big to fail" is how we would describe the megacap stocks in this article today.

While they will likely stand the test of time, it’s not all sunshine and rainbows as their scale can limit their ability to find new sources of growth.

Via StockStory · February 4, 2026

C WorldWide Group Loads Up 45,000 MercadoLibre Shares Worth $94 Millionfool.com

Via The Motley Fool · February 4, 2026

Despite trailing the S&P 500 Index over the past year, Visa continues to command strong confidence on Wall Street.

Via Barchart.com · February 4, 2026

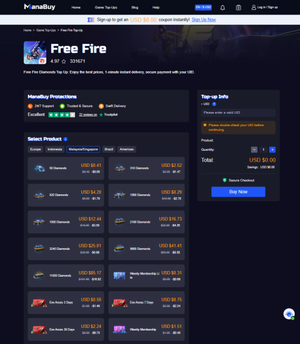

ManaBuy’s 2026 platform update enhances the Free Fire top-up experience with a faster purchase flow, clearer order tracking, improved local-currency checkout in select markets, quicker delivery after payment verification, and more competitive deals—while keeping transactions safer by fulfilling via the player’s UID without requiring passwords.

Via Binary News Network · February 4, 2026

Credit cards have been in the news a lot lately.

Via The Motley Fool · February 3, 2026

These world-class companies can pay you now and for years to come, raising their dividends along the way.

Via The Motley Fool · February 3, 2026

Gary Black, managing partner of Future Fund, said in a post on X that PayPal’s limitation is that it is very expensive for sellers compared to other online payment providers.

Via Stocktwits · February 3, 2026

Visa partners with UnionPay International to enable cross-border remittances to over 95% of UnionPay debit cardholders in Mainland China via Visa Direct by mid-2026.

Via Benzinga · February 3, 2026

At Web Summit Qatar, Visa (NYSE:V) and UnionPay International (UPI) announced an agreement to enable cross-border money movement into Chinese Mainland through Visa Direct. Once fully rolled out, clients will be able to send cross-border remittances and business-to-consumer payouts to more than 95 percent of UnionPay International debit cardholders in Chinese Mainland, through a single connection.

By Visa Inc. · Via Business Wire · February 3, 2026

On January 29, 2026, Mastercard Inc. (NYSE:MA) reported fourth-quarter and full-year 2025 financial results that comfortably surpassed Wall Street expectations, signaling that the global consumer remains remarkably resilient despite years of inflationary pressure. The company posted net revenue of $8.8 billion for the quarter, an 18% increase over

Via MarketMinute · February 2, 2026

The global payments landscape showed remarkable durability in the face of shifting macroeconomic winds as Visa (NYSE: V) reported its fiscal first-quarter 2026 earnings. Surpassing Wall Street expectations, the payment giant demonstrated that even as service-sector inflation remains "sticky" and geopolitical trade tensions introduce new variables like tariffs, the consumer's

Via MarketMinute · February 2, 2026

Better Payment Solutions announces expanded services that help small businesses save money on credit card processing fees and other customer payment solutions.

Via Press Release Distribution Service · February 2, 2026

The fintech titan is set to profit from stablecoins and agentic AI.

Via The Motley Fool · February 2, 2026

As of early February 2026, the resilience of the U.S. consumer has once again defied the skeptics. Despite years of fluctuating interest rates and persistent concerns over a cooling labor market, the latest fourth-quarter 2025 earnings from the world's largest payment processors have provided a definitive "all-clear" on the

Via MarketMinute · February 2, 2026