Chevron Corp (CVX)

150.02

-0.48 (-0.32%)

NYSE · Last Trade: Dec 28th, 9:31 AM EST

Buffett is positioning Berkshire's portfolio to help Greg Abel as he takes over in 2026.

Via The Motley Fool · December 27, 2025

Give yourself the gift of a reliable, growing income as we end one year and begin another.

Via The Motley Fool · December 26, 2025

As the final bells of 2025 ring across the floor of the New York Stock Exchange, the Dow Jones Industrial Average (DJI) stands at a historic crossroads. After a year defined by a resilient "soft landing" and a strategic rotation into "old economy" value stocks, the 30-stock benchmark is hovering

Via MarketMinute · December 26, 2025

As the final trading days of 2025 come to a close, the "Santa Claus rally" has pushed major indices to record highs, leaving investors with a sense of cautious optimism. However, the focus on Wall Street has already shifted toward 2026, a year that analysts are characterizing as a period

Via MarketMinute · December 26, 2025

As the final week of 2025 unfolds, the global commodity markets are witnessing a profound "Great Divergence." While precious and industrial metals have surged to historic, record-shattering heights, the energy and agricultural sectors are grappling with a softening demand outlook and a massive supply overhang. This split-screen reality is creating

Via MarketMinute · December 26, 2025

Brent crude oil futures climbed to $62.4 per barrel on Friday, December 26, 2025, marking a sharp reversal from mid-month lows and securing a significant weekly gain. This rally comes as a series of geopolitical flashpoints—ranging from a U.S. naval blockade in the Caribbean to drone strikes

Via MarketMinute · December 26, 2025

As the curtain closes on 2025, the global energy landscape stands at a fascinating crossroads. While the festive lights of late December shine bright, the oil markets are grappling with a year-end slump that has redefined the competitive hierarchy of the sector. On this Christmas Day, December 25, 2025, West

Via MarketMinute · December 25, 2025

ADEN/RIYADH — As the world observes the Christmas holiday, the geopolitical landscape of the Arabian Peninsula is undergoing its most violent transformation in years. A sweeping military offensive launched in early December by the Southern Transitional Council (STC)—Yemen’s primary separatist movement—has effectively dismantled the Saudi-backed unity government,

Via MarketMinute · December 25, 2025

As investors close the books on 2025, a year defined by the continued—yet tiring—dominance of artificial intelligence and mega-cap technology, the financial community is turning its gaze toward a simpler, time-tested strategy for the new year. The "Dogs of the Dow" strategy, which involves purchasing the ten highest-yielding

Via MarketMinute · December 25, 2025

The landscape of the global energy market has been fundamentally reshaped this year as Chevron (NYSE: CVX) successfully completed its $53 billion acquisition of Hess Corporation (NYSE: HES), marking the end of one of the most contentious corporate rivalries in recent memory. By securing a 30% stake in the prolific

Via MarketMinute · December 25, 2025

As of December 25, 2025, a high-stakes maritime standoff in the Caribbean has fundamentally reshaped the energy landscape. The U.S. government’s decision to implement a "quarantine" of sanctioned oil tankers near Venezuela has effectively severed one of the world’s most controversial supply chains. This aggressive maneuver, involving

Via MarketMinute · December 25, 2025

As the global energy market closes out 2025, the OPEC+ alliance has executed a high-stakes tactical maneuver designed to prevent a total price collapse in the face of a looming global supply glut. Following a modest production increase of 137,000 barrels per day (bpd) in December 2025, the cartel

Via MarketMinute · December 25, 2025

As the sun sets on the final trading sessions of 2025, the global financial markets are entering a period of deceptive calm. With many institutional desks shuttered for the holidays and trading volumes plummeting by as much as 50%, the remaining "thin" market has become a playground for extreme volatility.

Via MarketMinute · December 24, 2025

As the global energy market closes out a tumultuous 2025, the narrative has shifted from a simple supply-and-demand equation to a complex geopolitical chess match. With West Texas Intermediate (WTI) testing the $60 mark—down roughly 12% from this time last year—investors are grappling with a paradox: a market

Via MarketMinute · December 24, 2025

As the 2025 holiday season reaches its peak, the global energy landscape is defined by a stark and unusual divergence. While crude oil prices have found a tenuous floor, remaining steady despite a backdrop of structural oversupply, natural gas prices are experiencing a sharp retreat. This "Great Energy Decoupling" reflects

Via MarketMinute · December 24, 2025

As 2025 draws to a close, the divergence between the "new economy" and the "old economy" has reached a historic fever pitch. While the S&P 500 has surged to record highs, fueled by an insatiable appetite for artificial intelligence and mega-cap technology, traditional cyclical sectors—the bedrock of the

Via MarketMinute · December 23, 2025

In a move that underscores the shifting tides of the global energy capital markets, Sintana Energy (TSXV: SEI; AIM: SEI) officially commenced trading on the London Stock Exchange’s AIM market today, December 23, 2025. This dual listing marks a significant milestone for the Toronto-based junior explorer, which has rapidly

Via MarketMinute · December 23, 2025

As the calendar turns to late December 2025, the American energy sector finds itself in a state of high-octane contradiction. On one hand, the United States has solidified its status as the world’s undisputed energy superpower, with domestic crude oil production hitting a staggering record of 13.6 million

Via MarketMinute · December 23, 2025

As of December 23, 2025, the global energy market is grappling with a sense of profound déjà vu. Decades after the fuel lines and stagflation of the 1970s, a toxic cocktail of international disagreements, naval blockades, and supply chain fragility has once again pushed energy security to the forefront of

Via MarketMinute · December 23, 2025

As of December 23, 2025, the global energy landscape is grappling with a "super glut" that has sent West Texas Intermediate (WTI) crude oil prices tumbling to a multi-year low of approximately $58 per barrel. Despite a year marked by geopolitical volatility—ranging from U.S. naval blockades of Venezuelan

Via MarketMinute · December 23, 2025

The energy sector is volatile, so it is best to play it safe with these two high-yield options, which offer yields of up to 6.8%.

Via The Motley Fool · December 23, 2025

The Dogs of the Dow has long been a simple, rules-based approach to equity investing, built around owning the highest-yielding stocks in the Dow Jones Industrial Average. Each year, investors rotate into the 10 Dow components with the highest dividen...

Via Barchart.com · December 23, 2025

A global oil glut is sending oil prices lower, and oil stocks with them.

Via The Motley Fool · December 22, 2025

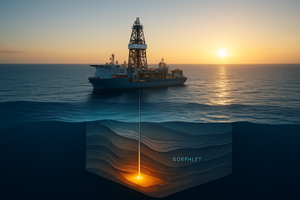

In a landmark announcement on December 22, 2025, energy giants Shell and INEOS Energy revealed a significant oil discovery at the Nashville exploration well, situated in the deepwater Norphlet play of the U.S. Gulf of Mexico—a region now increasingly referred to by industry and government officials as the

Via MarketMinute · December 22, 2025

As the calendar turns toward 2026, Morgan Stanley (NYSE:MS) has released a highly anticipated market outlook that navigates a narrow path between structural optimism and valuation-driven caution. The firm’s Global Investment Committee (GIC) has officially set a year-end 2026 target of 7,500 for the S&P 500,

Via MarketMinute · December 22, 2025