Latest News

Via Talk Markets · March 5, 2026

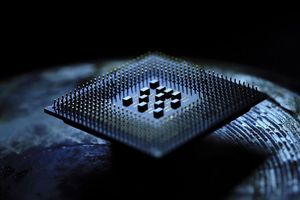

According to a report from Bloomberg, citing people familiar with the matter, the U.S. is working on draft regulations that would give the government power over global artificial intelligence chip exports to other countries.

Via Stocktwits · March 5, 2026

Kroger shares rise after the grocer beat quarterly profit estimates and expanded margins.

Via Benzinga · March 5, 2026

The company received an additional 180-day extension from Nasdaq to regain compliance after receiving an initial notice on Sept. 9, 2025.

Via Stocktwits · March 5, 2026

Here's my broad commentary around why Canadian stocks look cheap right now, and a couple top opportunities for investors to consider today.

Via The Motley Fool · March 5, 2026

Via Talk Markets · March 5, 2026

In addition to their impressive stock price rises over the years, each of these disruptive tech companies puts some money directly into their shareholders' pockets.

Via The Motley Fool · March 5, 2026

Amazon (AMZN) shares have broken short term resistance and are trading at levels that it had gapped down through.

Via Benzinga · March 5, 2026

Baidu delivers online marketing, cloud, and AI-powered services to businesses and consumers across China’s digital economy.

Via The Motley Fool · March 5, 2026

Amprius Technologies Inc (NYSE:AMPX) shares are trading higher on Thursday after the company reported fourth‑quarter results.

Via Benzinga · March 5, 2026

Via Benzinga · March 5, 2026

Via Talk Markets · March 5, 2026

AutoZone has underperformed the Dow recently, yet analysts remain highly optimistic about the stock’s prospects.

Via Barchart.com · March 5, 2026

Analyst Jesse Sobelson said the company currently provides limited clarity about when meaningful revenue growth might materialize.

Via Stocktwits · March 5, 2026

Solana (CRYPTO: SOL) is once again drawing attention across the crypto market, but this time the story is less about price swings and more about the sheer amount of capital moving thro

Via Benzinga · March 5, 2026

Tariffs are changing again, but energy investors need to remember that the biggest issue in the energy patch is oil prices.

Via The Motley Fool · March 5, 2026

Via Talk Markets · March 5, 2026

Evaxion A/S (NASDAQ:EVAX) Reports Wider-Than-Expected Q4 Loss, Stock Falls Over 30%chartmill.com

Via Chartmill · March 5, 2026

Ranpak (PACK) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 5, 2026

USAR acquires TMRC shares to accelerate its Accelerated Mining Plan at Round Top, aiming for large-scale rare earth and critical mineral production by 2028.

Via Benzinga · March 5, 2026

BJ's Wholesale Club flags tariffs and cautious consumers as fiscal 2026 outlook disappoints, sending shares lower despite Q4 beat.

Via Benzinga · March 5, 2026

Casella Waste Systems delivers integrated waste and recycling services across the northeastern U.S. with a vertically integrated model.

Via The Motley Fool · March 5, 2026

CPI Card stock costs much more today than it did yesterday. Is it still a buy?

Via The Motley Fool · March 5, 2026

Via Benzinga · March 5, 2026

Via Benzinga · March 5, 2026

What's going on in today's session: S&P500 moverschartmill.com

Via Chartmill · March 5, 2026

Promising progress in Q4 wasn't enough to offset investors' concerns about the insurer's lack of profitability.

Via The Motley Fool · March 5, 2026

Booking stock jumped after a report from The Information that OpenAI is "scaling back" plans to drive more shopping directly within ChatGPT.

Via Investor's Business Daily · March 5, 2026

Ituran (ITRN) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 5, 2026

Which stocks are experiencing notable movement on Thursday?chartmill.com

Via Chartmill · March 5, 2026

SoFi gained on Thursday as it rolled out a March 5–30 Cosmos Fund private-investment window tied to Colossal, OpenAI and Perplexity AI, while also spotlighting SoFiUSD's stablecoin infrastructure partnership with BitGo amid a broader market pullback.

Via Benzinga · March 5, 2026

In the past five years, this auto parts retailer has seen its shares more than triple.

Via The Motley Fool · March 5, 2026

May NY world sugar #11 (SBK26 ) today is up +0.08 (+0.58%), and May London ICE white sugar #5 (SWK26 ) is up +0.60 (+0.15%). Sugar prices recovered from early losses today and pushed higher, supported by soaring crude oil prices. WTI crude oil (CLJ2...

Via Barchart.com · March 5, 2026

Toro (TTC) Q1 2026 Earnings Call Transcript

Via The Motley Fool · March 5, 2026

The Mac Neo could be Apple's biggest hit in years.

Via The Motley Fool · March 5, 2026

Victoria's Secret & Co. shares fall premarket after beating Q4 EPS estimates at $2.77 and initiating a strategic review of DailyLook.

Via Benzinga · March 5, 2026

A simple concept has turned out to be hugely successful.

Via The Motley Fool · March 5, 2026

Intuitive Machines shares are trading lower Thursday, as investors reassess an early-week rally fueled by a new national-security contract.

Via Benzinga · March 5, 2026

The iShares MSCI South Korea ETF (EWY) just experienced a sudden dramatic drop. Here's what to know about what happened and what it means for U.S. investors.

Via Barchart.com · March 5, 2026

ICE buys stake in OKX at $25B valuation, OKB surges 50%. OKX's 120M users get access to ICE's US futures & tokenized equities markets.

Via Benzinga · March 5, 2026

Gene Munster predicts Big Tech capex will jump 65% in 2026 and 40% in 2027, far above Street estimates.

Via Benzinga · March 5, 2026

Viemed (VMD) Q4 2025 Earnings Call Transcript

Via The Motley Fool · March 5, 2026

Bitcoin (CRYPTO: BTC) has surged 7% since the start of the month as macro analyst Benjamin Cowen warned this mirrors the “bull

Via Benzinga · March 5, 2026

Cracker Barrel (CBRL) reported upbeat Q2 earnings but saw a decline in revenue. Analysts adjusted their price targets. Stock fell 1%.

Via Benzinga · March 5, 2026

CFO says company continues to be “strategic and opportunistic” in approach to securing capital needed for late-stage MASH trial.

Via Stocktwits · March 5, 2026