Wrapping up Q2 earnings, we look at the numbers and key takeaways for the infrastructure distributors stocks, including Watsco (NYSE:WSO) and its peers.

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

The 4 infrastructure distributors stocks we track reported a mixed Q2. As a group, revenues missed analysts’ consensus estimates by 1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.1% since the latest earnings results.

Weakest Q2: Watsco (NYSE:WSO)

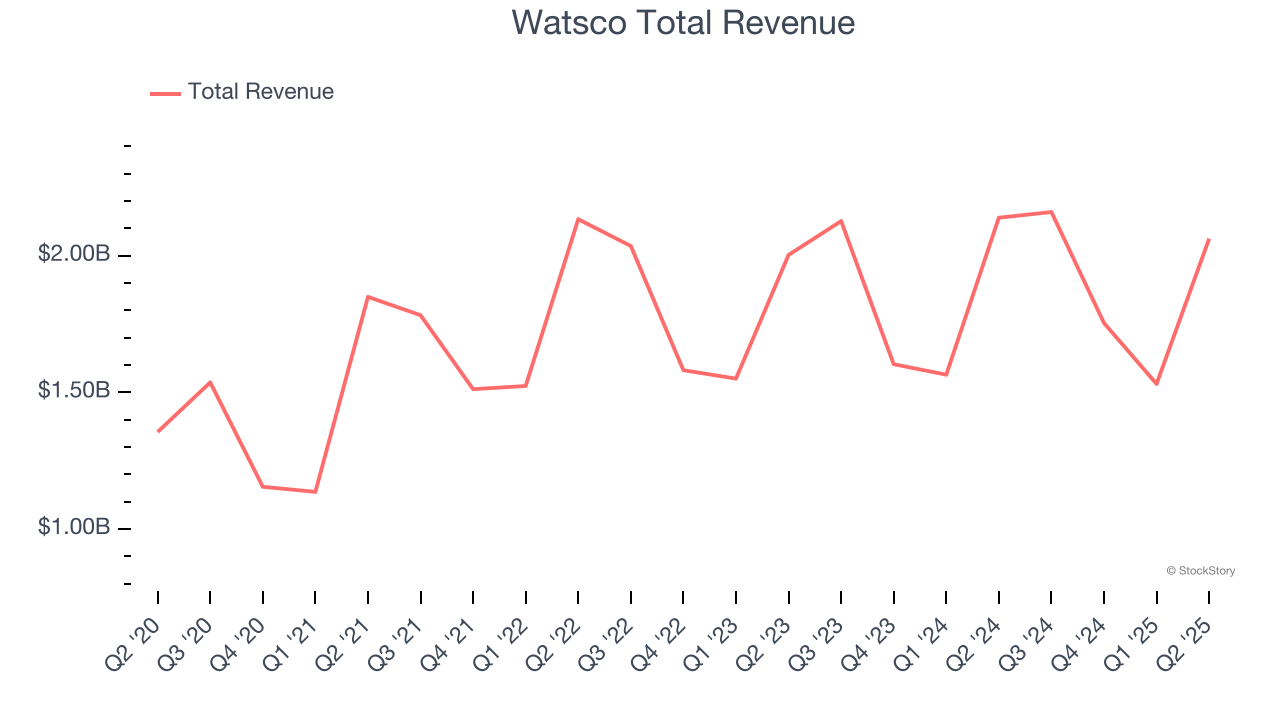

Originally a manufacturing company, Watsco (NYSE:WSO) today only distributes air conditioning, heating, and refrigeration equipment, as well as related parts and supplies.

Watsco reported revenues of $2.06 billion, down 3.6% year on year. This print fell short of analysts’ expectations by 7.2%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

Watsco delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 16.8% since reporting and currently trades at $386.52.

Read our full report on Watsco here, it’s free.

Best Q2: DistributionNOW (NYSE:DNOW)

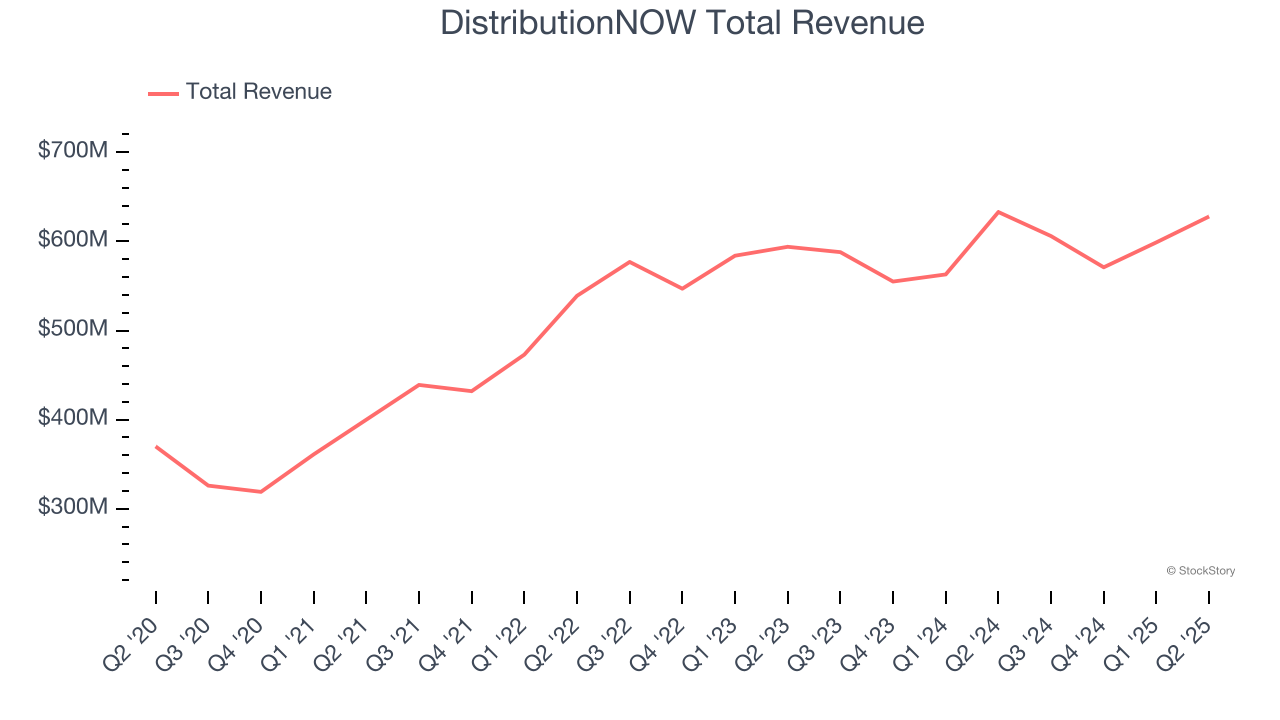

Spun off from National Oilwell Varco, DistributionNOW (NYSE:DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

DistributionNOW reported revenues of $628 million, flat year on year, outperforming analysts’ expectations by 2.6%. The business had a stunning quarter with a beat of analysts’ EPS and EBITDA estimates.

DistributionNOW scored the biggest analyst estimates beat among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $15.35.

Is now the time to buy DistributionNOW? Access our full analysis of the earnings results here, it’s free.

Core & Main (NYSE:CNM)

Formerly a division of industrial distributor HD Supply, Core & Main (NYSE:CNM) is a provider of water, wastewater, and fire protection products and services.

Core & Main reported revenues of $2.09 billion, up 6.6% year on year, falling short of analysts’ expectations by 1%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 25.2% since the results and currently trades at $49.76.

Read our full analysis of Core & Main’s results here.

MRC Global (NYSE:MRC)

Producing bomb casings and tracks for vehicles during WWII, MRC (NYSE:MRC) offers pipes, valves, and fitting products for various industries.

MRC Global reported revenues of $798 million, flat year on year. This result topped analysts’ expectations by 1.7%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and EPS in line with analysts’ estimates.

The stock is flat since reporting and currently trades at $14.48.

Read our full, actionable report on MRC Global here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.