Let’s dig into the relative performance of DocuSign (NASDAQ:DOCU) and its peers as we unravel the now-completed Q2 productivity software earnings season.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.5% while next quarter’s revenue guidance was in line.

Luckily, productivity software stocks have performed well with share prices up 10.3% on average since the latest earnings results.

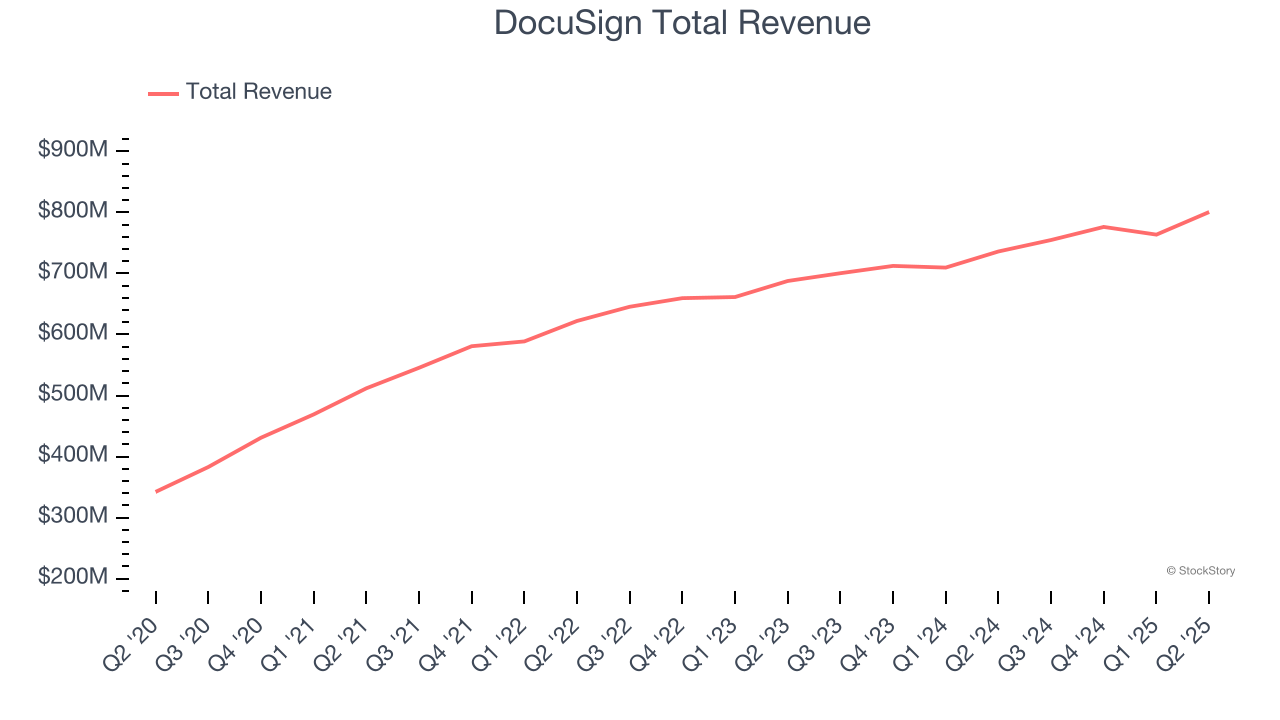

DocuSign (NASDAQ:DOCU)

Creating the digital equivalent of "sign on the dotted line" for over a billion users worldwide, DocuSign (NASDAQ:DOCU) provides an agreement management platform that enables businesses to electronically prepare, sign, and manage documents and contracts.

DocuSign reported revenues of $800.6 million, up 8.8% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ annual recurring revenue estimates.

"Q2 was an outstanding quarter, with AI innovation launches and recent go-to-market changes leading to strong performance across the eSignature, CLM, and IAM businesses," said Allan Thygesen, CEO of Docusign.

Interestingly, the stock is up 6.2% since reporting and currently trades at $81.

Is now the time to buy DocuSign? Access our full analysis of the earnings results here, it’s free.

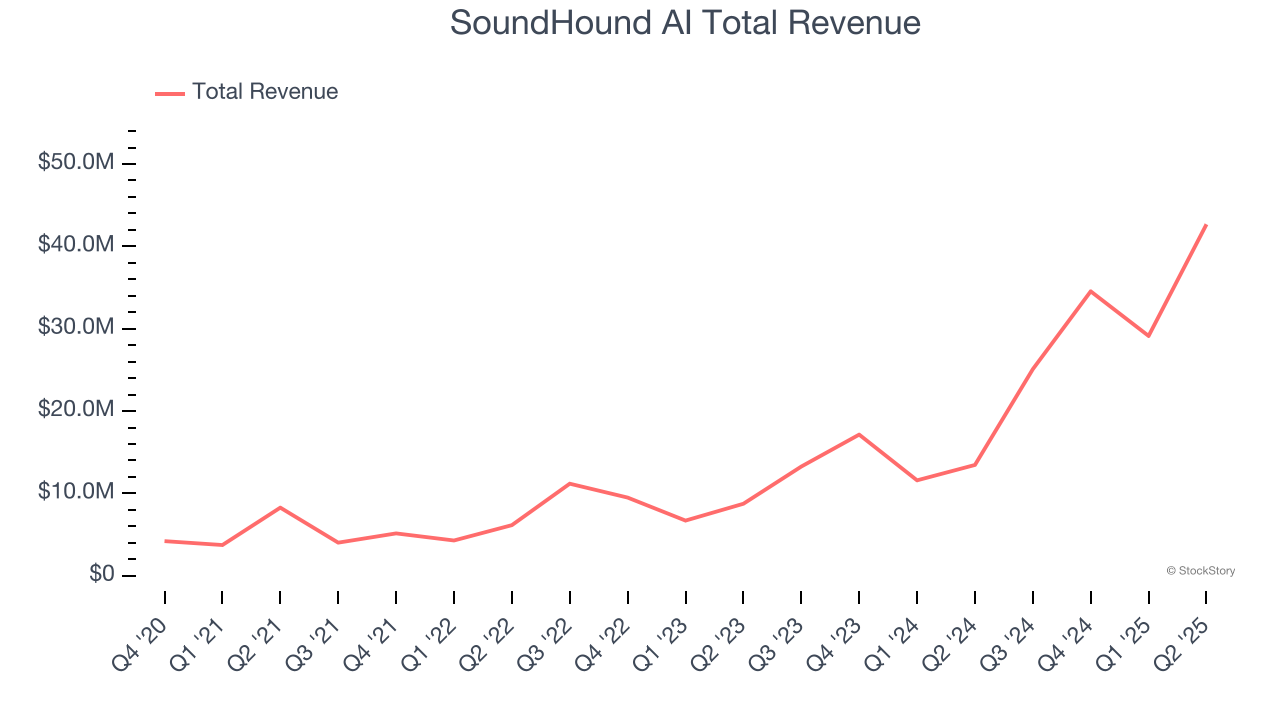

Best Q2: SoundHound AI (NASDAQ:SOUN)

Born from the idea that machines should understand human speech as naturally as people do, SoundHound AI (NASDAQ:SOUN) develops voice recognition and conversational intelligence technology that enables businesses to integrate voice assistants into their products and services.

SoundHound AI reported revenues of $42.68 million, up 217% year on year, outperforming analysts’ expectations by 31.2%. The business had an incredible quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

SoundHound AI delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 33.5% since reporting. It currently trades at $14.35.

Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: 8x8 (NASDAQ:EGHT)

Named after its founding year (1987) with "8x8" representing binary code for communications, 8x8 (NASDAQ:EGHT) provides cloud-based contact center and unified communications solutions that enable businesses to manage customer interactions and internal communications through a single platform.

8x8 reported revenues of $181.4 million, up 1.8% year on year, exceeding analysts’ expectations by 2.2%. Still, it was a mixed quarter as it posted a significant miss of analysts’ EBITDA estimates.

8x8 delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 10.6% since the results and currently trades at $2.13.

Read our full analysis of 8x8’s results here.

Microsoft (NASDAQ:MSFT)

Originally named "Micro-soft" for microcomputer software when founded in 1975, Microsoft (NASDAQ:MSFT) is a global technology company that develops software, cloud services, devices, and AI solutions for consumers, businesses, and organizations worldwide.

Microsoft reported revenues of $76.44 billion, up 18.1% year on year. This result surpassed analysts’ expectations by 3.5%. Overall, it was an exceptional quarter as it also recorded a narrow beat of analysts’ revenue estimates, as Personal Computing, Intelligent Cloud, and Business Services all beat and an impressive beat of analysts’ operating income estimates.

The stock is flat since reporting and currently trades at $515.76.

Read our full, actionable report on Microsoft here, it’s free.

Asana (NYSE:ASAN)

Born from the founders' frustration with the inefficiencies of email-based collaboration at Facebook, Asana (NYSE:ASAN) provides a work management platform that helps organizations track projects, set goals, and manage workflows in a centralized digital workspace.

Asana reported revenues of $196.9 million, up 9.9% year on year. This print topped analysts’ expectations by 2%. It was a very strong quarter as it also put up EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The company added 709 enterprise customers paying more than $5,000 annually to reach a total of 25,006. The stock is down 5.9% since reporting and currently trades at $13.40.

Read our full, actionable report on Asana here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.