Shareholders of The Trade Desk would probably like to forget the past six months even happened. The stock dropped 27.9% and now trades at $88.41. This might have investors contemplating their next move.

Given the weaker price action, is this a buying opportunity for TTD? Find out in our full research report, it’s free.

Why Are We Positive On The Trade Desk?

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

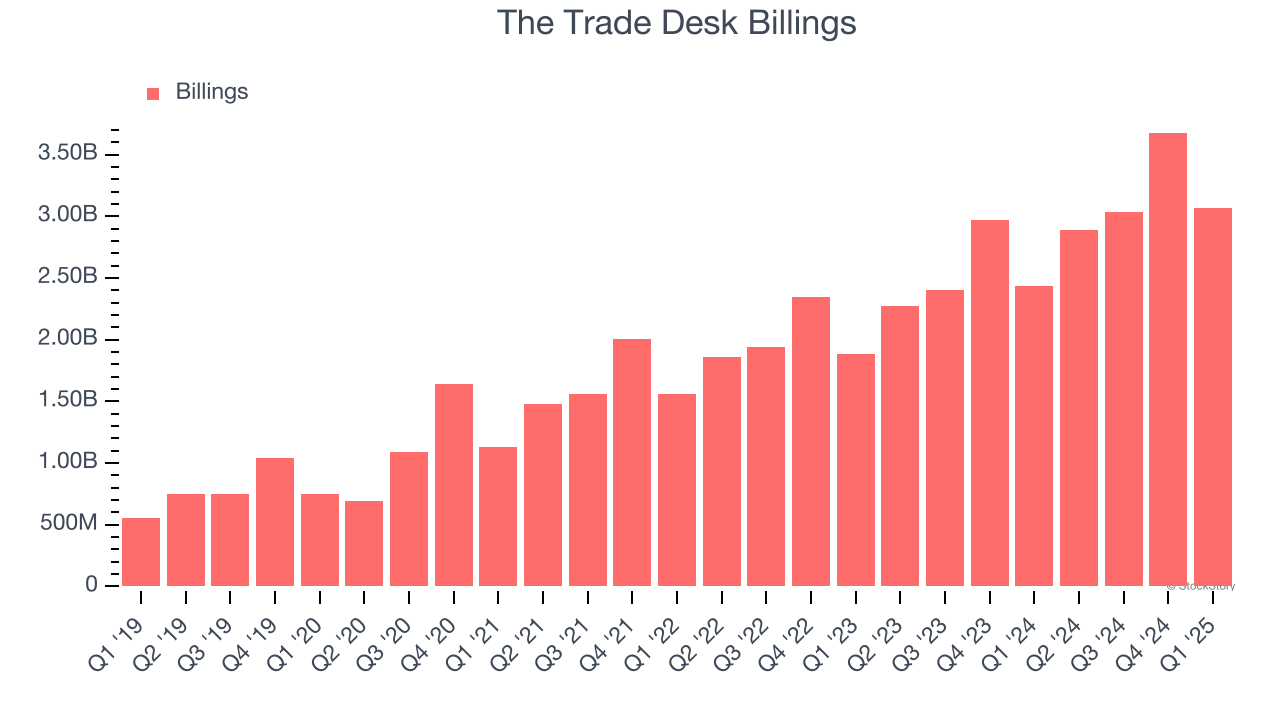

1. Billings Surge, Boosting Cash On Hand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

The Trade Desk’s billings punched in at $3.07 billion in Q1, and over the last four quarters, its year-on-year growth averaged 25.8%. This performance was impressive, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

The Trade Desk is extremely efficient at acquiring new customers, and its CAC payback period checked in at 4 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give The Trade Desk more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

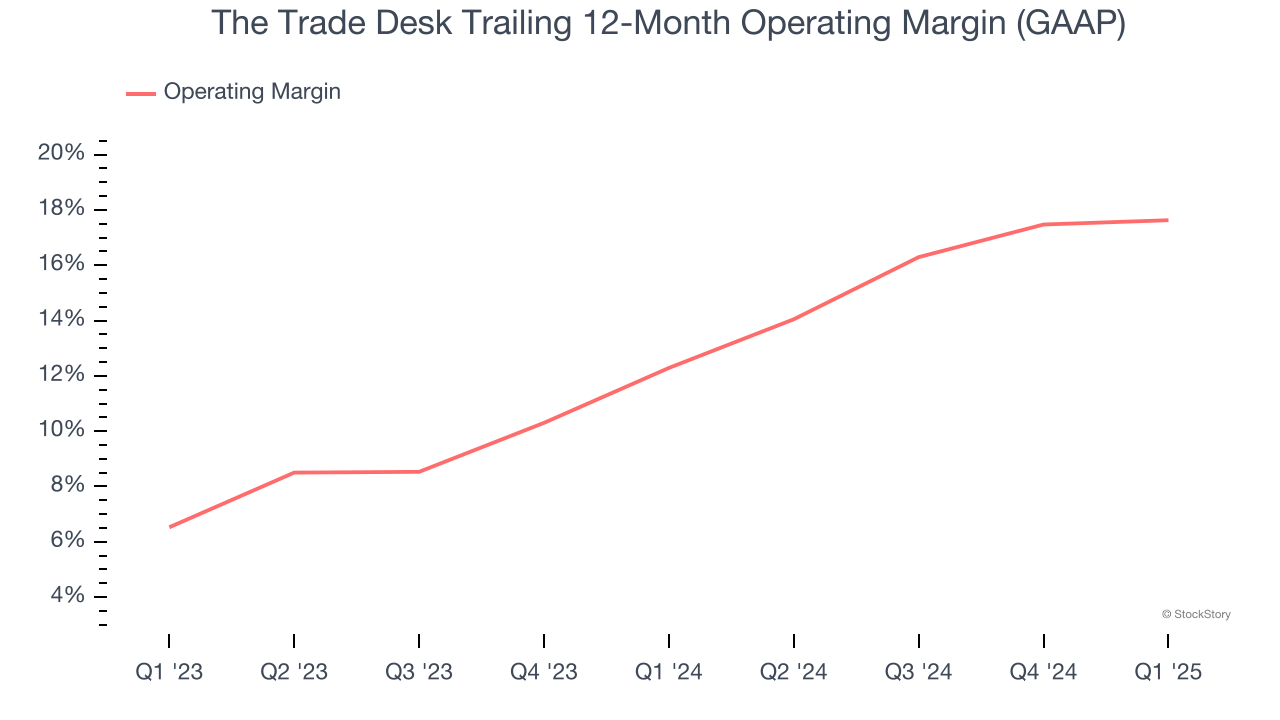

3. Operating Margin Reveals a Well-Run Organization

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

The Trade Desk has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 17.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Final Judgment

These are just a few reasons The Trade Desk is a rock-solid business worth owning. With the recent decline, the stock trades at 15× forward price-to-sales (or $88.41 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.