Seattle, Washington-based Weyerhaeuser Company (WY) is one of the world's largest private owners of timberlands. The company has a market cap of $18.6 billion and owns or controls approximately 10.4 million acres of timberlands in the United States, as well as additional public timberlands managed under long-term licenses in Canada.

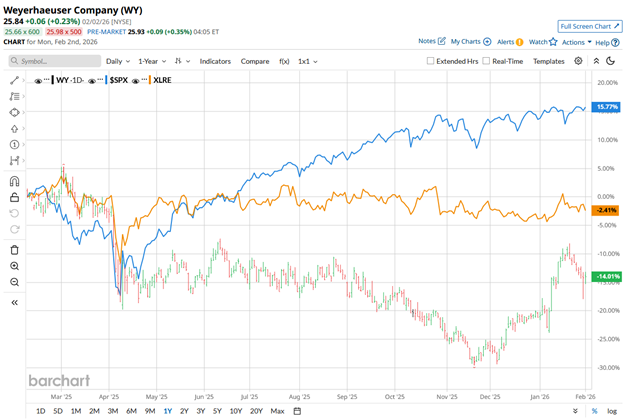

Shares of the company have lagged behind the broader market over the past year, but have outperformed in 2026. WY stock has declined 15.6% over the past 52 weeks and has grown 9.1% on a YTD basis. In comparison, the S&P 500 Index ($SPX) has returned 15.5% over the past year and risen 1.9% in 2026.

Narrowing the focus, WY has underperformed the State Street Real Estate Select Sector SPDR ETF’s (XLRE) 1.1% decline over the past 52 weeks, but has edged past its 1.5% increase this year.

On Dec. 11, WY shares rose marginally following the company’s announcement of its memorandum of understanding (MOU) with Aymium to partner to produce and sell 1.5 million tons of sustainable biocarbon annually for use in metals production. This initiative represents a strategic shift toward low-emissions alternatives to coal.

For the fiscal year ending in December 2026, analysts expect WY to report an 10% year-over-year growth in adjusted EPS to $0.22. The company has a good earnings surprise history. It has surpassed and matched the Street’s bottom-line estimates in each of the past four quarters.

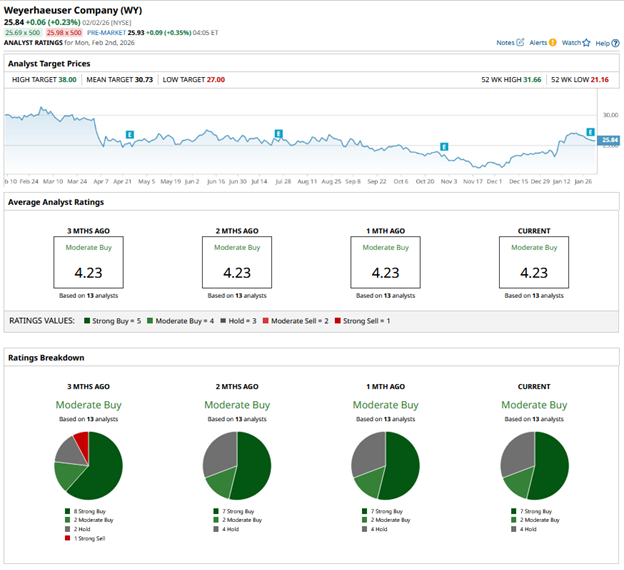

WY has a consensus “Moderate Buy” rating overall. Of the 13 analysts covering the stock, opinions include seven “Strong Buys,” two “Moderate Buys,” and four “Holds.”

The configuration has become less bullish. Compared with three months ago, WY stock now has seven “Strong Buy” ratings, down from eight.

On Feb. 2, DA Davidson analyst Kurt Yinger maintained a "Buy" rating for Weyerhaeuser stock and set a price target of $31.

WY’s mean price target of $30.73 indicates a 18.9% premium to the current market prices. Its Street-high target of $38 suggests a robust 47.1% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After the Silver Futures Price Crash, This Technical Demand Zone Marks the Next Buy Opportunity

- Nio Just Broke Below Its 20-Day Moving Average Despite Nearly Doubled Deliveries. How Should You Play NIO Stock Here?

- 1 Promising Stock That Just Hit New 52-Week Highs

- Dear AMD Stock Fans, Mark Your Calendars for February 3