With a market cap of $35.3 billion, Cognizant Technology Solutions Corporation (CTSH) is a leading global professional services company. It provides consulting, technology, and outsourcing services across North America, Europe, and international markets, with a strong focus on digital transformation in areas such as AI, cloud, IoT, and experience-driven software engineering.

Shares of the Teaneck, New Jersey-based company have lagged behind the broader market over the past 52 weeks. CTSH stock has dipped 2.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 17.6%. Moreover, shares of the company have decreased 5.7% on a YTD basis, compared to SPX's 16.3% rise.

Looking closer, shares of the information technology consulting and outsourcing firm have also underperformed the Technology Select Sector SPDR Fund's (XLK) return of 30.8% over the past 52 weeks.

Shares of Cognizant soared 5.7% on Oct. 29 after the company reported Q3 2025 adjusted EPS of $1.39 and revenue of $5.42 billion, beating estimates. The company also raised its full-year adjusted profit forecast to $5.22 per share - $5.26 per share and lifted the lower end of its annual revenue outlook to $21.05 billion. Investor optimism was further fueled by Cognizant’s strong AI-driven growth strategy and expectations of increased enterprise spending on digital infrastructure.

For the fiscal year ending in December 2025, analysts expect CTSH's adjusted EPS to grow 10.5% year-over-year to $5.25. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

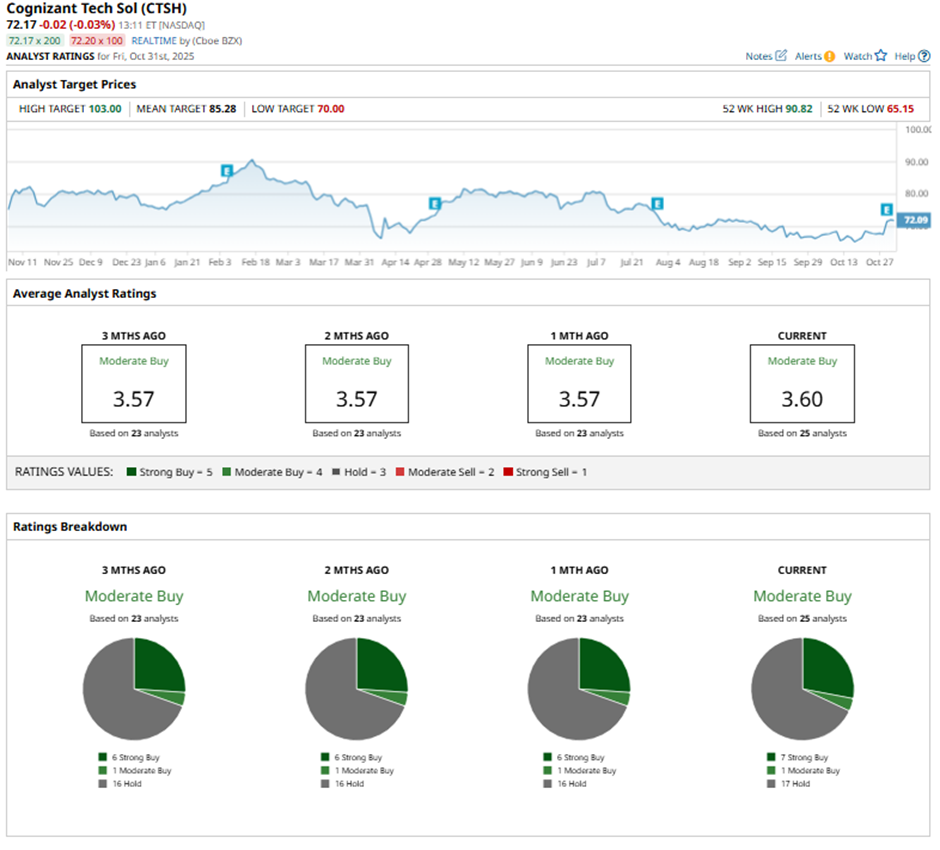

Among the 25 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buys,” one “Moderate Buy” rating, and 17 “Holds.”

This configuration is slightly more bullish than three months ago, with six “Strong Buy” ratings on the stock.

On Oct. 30, JPMorgan raised its price target on Cognizant to $92 and maintained an “Overweight” rating.

The mean price target of $85.28 represents an 18.2% premium to CTSH’s current price levels. The Street-high price target of $103 suggests a 42.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Just Slashed His Fiserv Stock Price Target by 55%. Should You Jump Ship Now?

- 'Aggressive' Spending Spooks Meta Platforms Investors. Should You Buy the Dip in META Stock?

- A $135 Billion Reason to Buy Microsoft Stock Now

- 3 Options Strategies. 3 Unusually Active Options. 3 Long-Term Stocks to Buy.